We empower fintech with innovative technology solutions.

Algorithmic Trading

Utilize our advanced algorithmic trading strategies for precise, automated trade execution across various financial markets. Our Python-based solutions ensure speed and accuracy in the Indian stock market and beyond.

Quantitative Research

Access detailed quantitative research reports and analyses that offer critical insights into market trends, risks, and investment opportunities. We provide data-driven research for both US and Indian stocks and options.

Risk Management

Employ our robust risk management models to effectively mitigate risks in your investment strategies. Our tailored solutions align with your risk tolerance and financial objectives, ensuring better protection against market fluctuations.

Portfolio Optimization

Optimize your investment portfolio with sophisticated quantitative techniques designed to maximize returns while minimizing risk. Our optimization strategies are backed by continuous analysis and refinement.

Data Analytics

Leverage advanced data analytics tools to gain a competitive edge. Our services include Monte Carlo simulations and predictive modeling using open-source AI tools, enhancing your decision-making and strategic planning.

Full-Time Quant Developers

Hire expert quant developers from our Indian office, specializing in market analysis, technical indicators, and Python algorithms. Our team offers full-time support for custom trading solutions.

Agency Services

Engage with us as an agency to purchase blocks of hours for dedicated project work. Our team of experts will collaborate to deliver tailored solutions, providing a comprehensive approach to your trading and market needs.

Crypto & Blockchain Solutions

Explore our cryptocurrency investments and blockchain technology expertise. We offer smart token generation, secure wallet management (MetaMask, Trezor, Ledger), and trading on Gate.io, CoinDesk, and Binance.

Historical Data Analysis

Benefit from our extensive historical data analysis for both stocks and options. Our data-driven insights support backtesting and strategy development, helping you make informed investment decisions.

Custom Trading Solutions

Get bespoke trading solutions tailored to your specific needs. We offer custom algorithm development, strategy implementation, and system integration to fit your unique trading requirements.

Market Simulation and Training

Enhance your trading skills with our market simulation and training services. We provide simulated trading environments and training sessions to help you master trading strategies and techniques.

Solution Expertise

BacktestPro – Backtesting and Strategy Validation:Offering advanced backtesting frameworks to simulate and validate trading strategies using historical data for optimized performance.

AlgoCode – Algorithm Coding and Development:Customizing and coding high-frequency trading algorithms tailored to specific market conditions and asset classes for precise execution.

TradeGuard – Real-time Trading Monitoring: Implementing real-time monitoring solutions for algorithmic trading systems, ensuring performance tracking, risk management, and immediate intervention when needed.

StratOptimizer – Strategy Optimization and Tuning: Fine-tuning trading strategies through iterative testing and optimization to ensure they are adaptive to changing market conditions.

MarketPulse – Market Data Integration: Seamlessly integrating real-time and historical market data to enhance the precision and performance of backtested strategies.

Business Cases

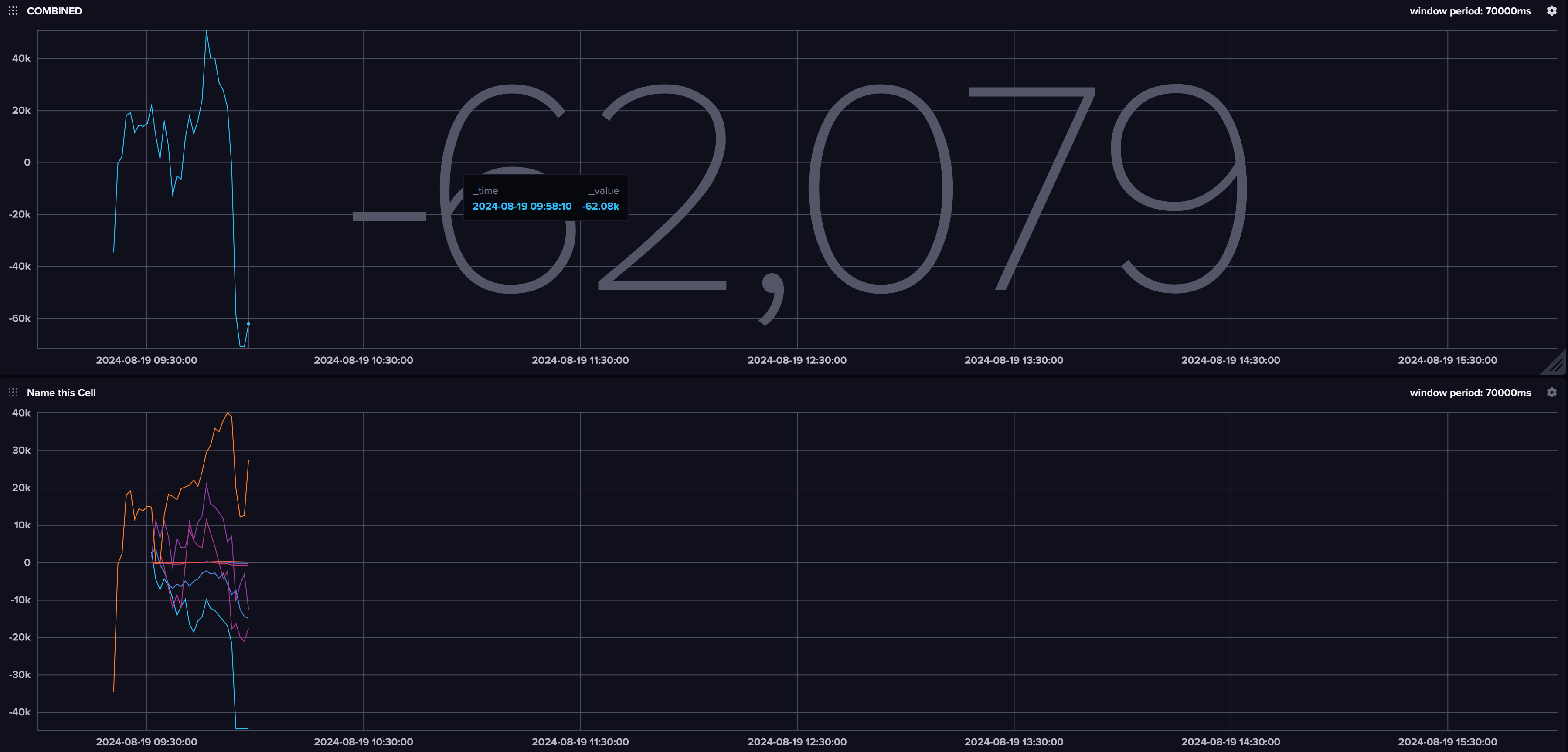

A Mumbai based proprietary trading firm was facing challenges in optimizing their algorithmic trading strategies due to inefficiencies in backtesting and real-time market data integration. These issues led to suboptimal performance, delayed trade execution, and increased risk exposure. To resolve this, we implemented a robust backtesting framework that simulated strategies using historical data, integrated real-time market feeds, and optimized code for faster execution. The solution improved strategy validation, enhanced risk management, and increased trading profitability by enabling faster, data-driven decision-making, ultimately driving better returns and minimizing losses.

Showcase

Industries We Serve

Healthcare

Engineering

Fintech

Retail & Ecommerce

Telecommunication

Human Capital

Rigel Team Profile

- Effective Communication – Specific, precise, clean and concise

- Clean code with best code practices

- Critical thinking and adaptability to latest changes

- Debugging, troubleshooting and problem solving

- Scrum / Agile development process

- Domain specific expertise

- Clear documentation

- Focus on reliable, scalable and high performance

- IP-rights and NDA protection

- Certified resources

- On demand peer colleagues expertise

- Secured access with finger print, VPN, two-factor authentication

- Time zone compatibility

- High end hardware for fast programming – laptops, dual screen, etc

- Pleasant office space/environment for enhanced productivity

- Timelogs and reporting

Engagement

Terms: Pay Per Hour | Pay Per Week | Fixed Cost | Revenue/Profit Share | Pay Per User/Subscription/Instance | ESOP | Retainer | Hybrid

Location: Onsite | Offshore| Hybrid Onsite and Remote

Onboarding: Within 4 weeks | Quick team scaling

Process: Submit Inquiry –> Business Need Concall –> NDA –> Rigel Proposition –> Agreement –> Onboarding